The combination of AI and accounting keeps revolutionizing tax and accounting industries with unprecedented efficiency and strategic capabilities. In 2024, companies are exploiting the use of AI to improve accuracy, automate repetitive tasks, and enable real-time financial insights, thus freeing individuals for more intricate advisory services that have more impact. It is an evolution that underscores the crucial role AI plays in redefining industry standards setting a new benchmark of excellence in tax accounting.

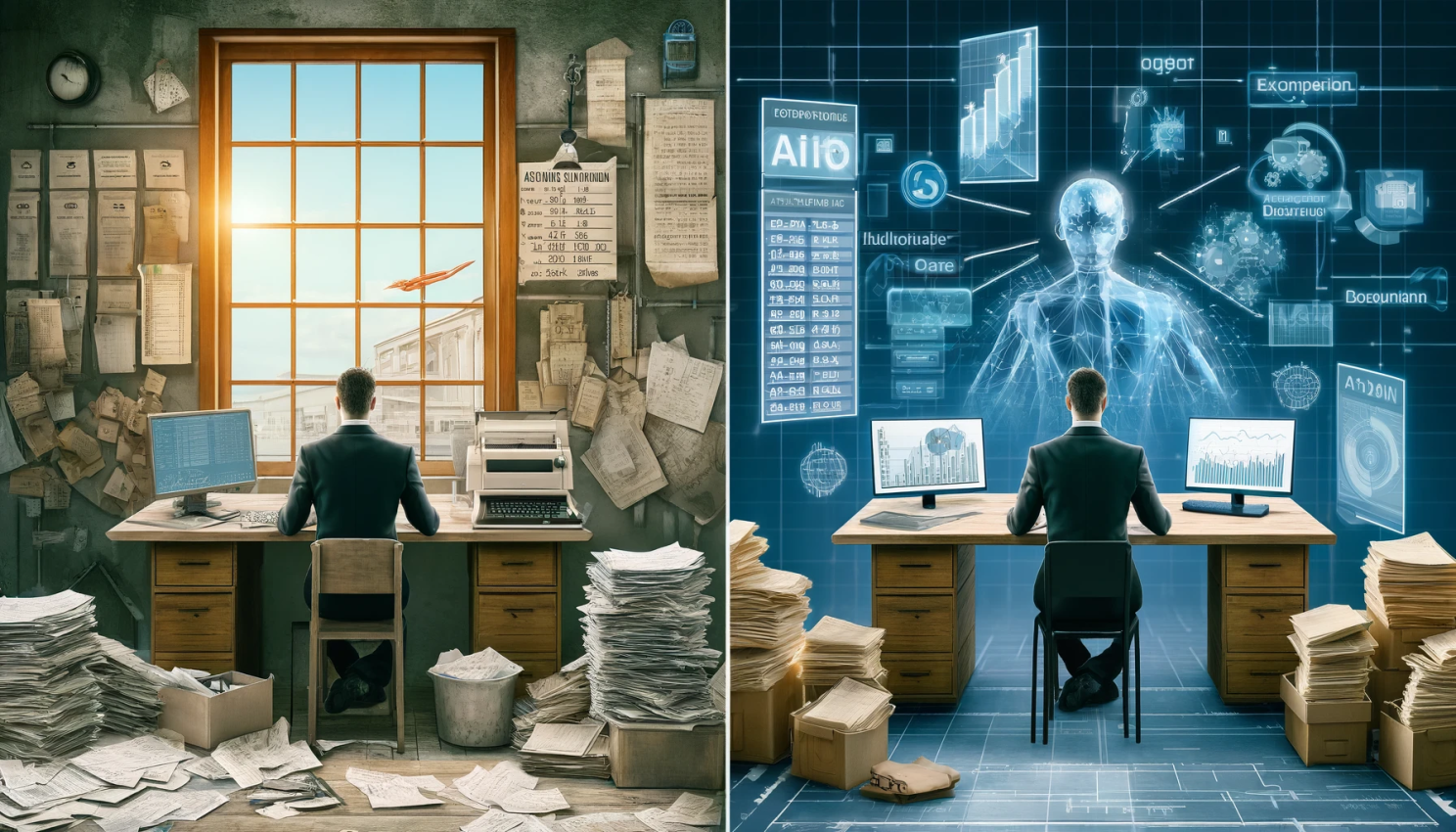

Accounting as well as tax advising entailed time-consuming manual processes before AI’s integration into the sector. To be precise, accountants spent long hours on manual record keeping and data entry with each financial transaction requiring careful recording which was however not without errors that could have adversely affected financial statements and tax filings.

Storing physical documents involved using large spaces because they were made up of countless paper documents like invoices and receipts hence making it difficult to retrieve any document whenever the need arose. Knowledge updates concerning taxation laws change as well as financial regulation changes were also regular requirements since tax laws keep changing at a fast pace.

It was a slow process to perform financial analysis and reporting by employing basic tools that compromised the possibility of real-time insights thus delaying important strategic decisions. Due to heavy reliance on face-to-face meetings, client interactions become infrequent and not immediate enough for consultancy services hence low levels of customer satisfaction.

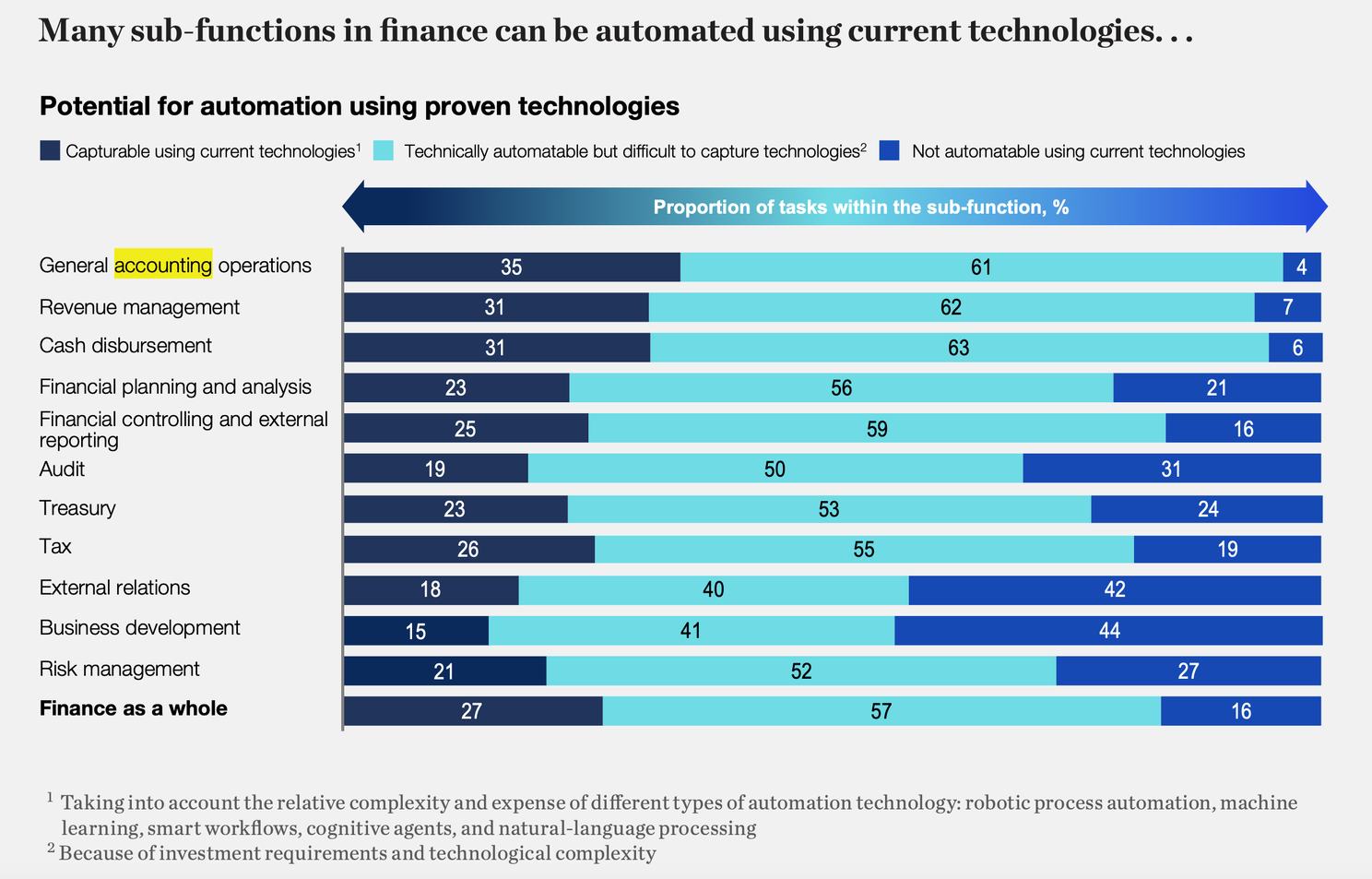

In their groundbreaking 2018 article “How bots, algorithms, and artificial intelligence are reshaping the future of corporate support functions“, McKinsey & Company showed the tremendous possibilities of AI and its derivatives in simplifying corporate support functions with a focus on finance departments. They noted that robotic process automation, machine learning, smart workflows, and natural-language processing might drastically cut general and administrative costs creating space for more time and resources. What was also clear from McKinsey’s insights is how much could be done using already available technologies as well as what still needed attention due to investment requirements and intricacies of technology.

These conventional practices have been transformed through the emergence of AI in accounting. Automation has led to a significant reduction in manual labor by automating repetitive tasks such as data entry, which was done manually before. Digital document management systems enhanced with AI have made storage and retrieval processes seamless. Constant check by compliance tools powered by artificial intelligence ensures precision and adherence to rules. Advanced analytics generate up-to-date financial information required for planning while virtual interactions driven by AI upgrade client service with increased responsiveness.

This shift exemplifies how AI is revolutionizing the accountancy and tax advice industries beyond mere automation into more efficient operationalization paths.

Key Developments and Applications

AI’s integration into accounting practices automates traditional tasks such as data entry, transaction categorization, and complex calculations. This shift not only streamlines workflows but also reduces the potential for human error, ensuring more reliable financial records.

Predictive Analytics and Decision Support

Advanced AI tools offer predictive insights, forecasting financial trends and enabling better strategic planning. These capabilities support tax planning and liability predictions, assisting firms in becoming more proactive rather than reactive.

Regulatory Compliance and Data Management

AI excels in managing and navigating the complex landscape of tax legislation and accounting standards. By automating compliance tasks and ensuring up-to-date reporting, AI tools help firms adhere to current regulations while efficiently handling internal processes like document management and authorization.

By reducing the time spent on routine tasks, AI allows tax professionals to focus on providing personalized financial advice and expanding their service offerings. This shift not only enhances client satisfaction but also increases the strategic value firms offer.

AI-driven tools integrate with business intelligence systems to provide comprehensive analyses that support significant business decisions. This integration is crucial for dynamic pricing models, financial forecasting, and scenario generation, which are essential for strategic planning and performance improvement.

Challenges and Considerations

Nonetheless, there are also some issues concerning data security, quality of input data, and integration with legacy systems that arise from incorporating AI into tax and accounting. Concerning this matter, firms must stress the need for accurate information as well as protection against any unauthorized access or destruction of sensitive data to avoid costly errors or breaches. Besides that, continuous training with adaptation is vital for keeping up with technological advancements to optimize AI applications.

Summary & Future Outlook

Financial analysis and reporting processes were slow and used basic tools that limited the ability to provide real-time insights, hence delaying strategic decision-making. Client interactions, heavily reliant on face-to-face meetings, limited the frequency and immediacy of advisory services, affecting client satisfaction.

The future of AI technology in accounting is thought to be cutting across the industry boundaries having implications on job roles and industry practices. As such, ongoing developments are expected not only to improve operational efficiencies but also to redefine the strategic role of tax and accounting professionals.

Indeed, this change in Tax and Accounting by way of AI is no longer a trend but a shift toward an efficient, accurate, and strategic future. Therefore as it progresses through 2024, the success or lack of it of firms may depend on how well they adapt or embrace these changes in their marketplaces.